Stamp duty is levied on property transactions that take place throughout Mumbai. Payment of stamp duty in Mumbai guarantees that the property transaction is properly recorded in government records. Continue reading here.

Mumbai is also recognized as India’s commercial capital due to its economic importance and commercial prowess. Mumbai’s real estate and property market has become a popular real estate investment destination as a result of its economic strength. Stamp duty revenue in Mumbai contributes significantly to the state’s budget.

The Maharashtra government determines the stamp duty charges in Mumbai. When the market is slow or demand is low, the state government decreases stamp duty payments to encourage property registrations in Mumbai.

What is stamp duty in Mumbai?

It is a government charge that makes your property purchase lawful. Without it, the ownership is not totally legal on paper. Men pay 6% of the property’s worth in stamp duty, whereas women pay only 5%. In addition, a registration fee is required. If your property is worth more than Rs. 30 lakh, the price is set at Rs. 30,000. If it is less expensive, you will be required to pay a registration fee of 1% of the property’s worth.

Stamp Duty and Registration Charges in Mumbai

Stamp duty charges in Mumbai are set by the state government. Male and female homebuyers pay separate stamp duties in Mumbai. Previously, stamp duty payments in Mumbai were 5% for male buyers and 4% for female buyers. However, in April 2022, the Maharashtra government agreed to collect a 1% metro cess in four cities. Four cities are involved: Thane, Nagpur, Pune, and Mumbai.

The following is a summary of Mumbai’s stamp duty:

| Ownership | Stamp Duty in Mumbai | Registration Charges |

| Male | 6% (5% Stamp Duty + 1% Metro Cess) | For property transactions above Rs 30 lakh

– Rs 30,000 For Property transactions below Rs 30 lakh – 1 percent of the property value |

| Female | 5% (4% Stamp Duty + 1% Metro Cess) | |

| Joint (Male + Female) | 6.5% |

The stamp duty charges in Mumbai are as follows, broken down by region:

| Area | Stamp duty | Registration Charges |

| South Mumbai | 5%+1% metro cess | 1% |

| Central Mumbai | 5%+1% metro cess | 1% |

| Western Mumbai | 5%+1% metro cess | 1% |

| Harbour | 5%+1% metro cess | 1% |

| Thane | 6%+1% metro cess | 1% |

| Navi Mumbai | 6%+1% metro cess | 1% |

Mumbai Stamp Duty and Registration Fees for Different Deeds

Depending on the form of deed, Mumbai has varied stamp duty rates. The following are the charges:

| Instrument | Stamp Duty Charges |

| Power of Attorney (PoA) | 5% for properties within municipal limits, 3% for properties within Gram Panchayat |

| Lease Agreement | 5% |

| Gift Deed | 3% |

| Gift Deed (Within family) | Rs 200 |

How to Calculate Stamp Duty in Mumbai

The stamp duty rate varies according to the buyer; in Mumbai, it is marginally lower for women. You must use the appropriate rate to determine the stamp duty on the entire property amount.

The registration fee should then be included. This fee is set at Rs. 30,000 if the property costs more than Rs. 30 lakh. If not, it represents 1% of the property’s worth.

You will know the total amount you must pay once you have added these two amounts.

An example of how to calculate stamp duty in Mumbai

Sumeet purchased a flat in Mumbai for Rs. 1.2 crore.

Now let’s see how much more he’ll have to pay:

Stamp duty equals 6% of Rs. 1,20,00,000, or Rs. 7,20,000

Registration charges are set at Rs. 30,000 because the flat costs more than Rs. 30 lakh.

So, Tushar needs to pay Rs. 7.5 lakh.

Factors Influencing Mumbai’s Stamp Duty and Registration Charges

In Mumbai, registration taxes and stamp duty are affected by a variety of circumstances. The factors are as follows:

Property Type: Residential homes pay somewhat lower registration charges in Mumbai than commercial properties.

Property’s Age: The stamp duty and registration charges are heavily influenced by the property’s age. The cost of purchasing a new property will be higher than that of purchasing an existing one.

Age of the Buyer: In Maharashtra, elderly people may be eligible for a discount on stamp duty and registration.

Location of the Property: The location of the property is a quiet aspect that influences the charges. Stamp duty is calculated using the ready reckoner rate, which varies depending on the property’s location. A fancy neighbourhood will have higher rates.

Gender of the Buyer: The government has reduced stamp duty charges for women in Maharashtra.

How to Pay Stamp Duty Charges in Mumbai

Once the stamp duty has been calculated, you can pay it in Mumbai either online or offline, depending on your preference.

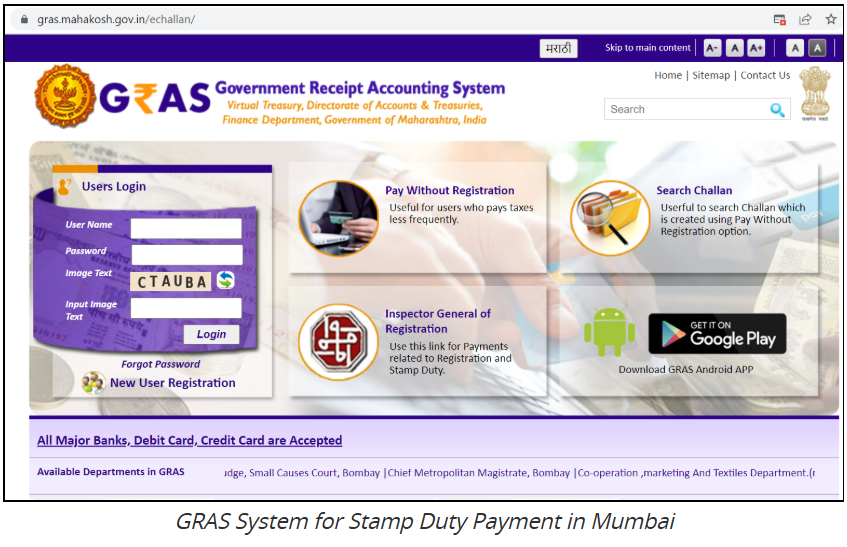

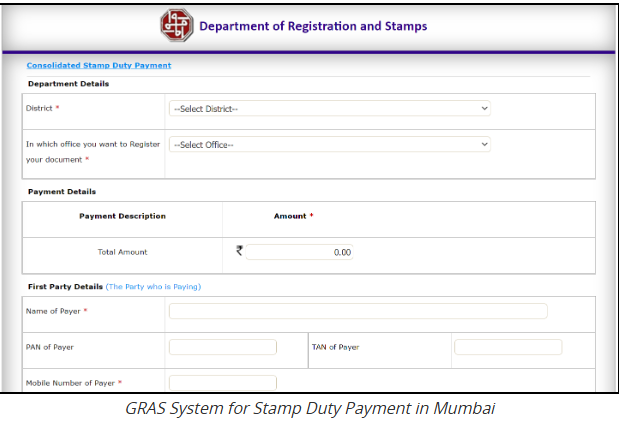

Online Payment of Stamp Duty in Mumbai

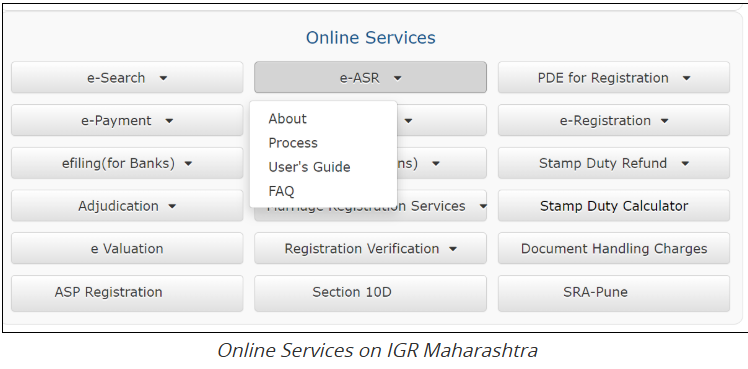

You can pay your stamp duty fee online in Mumbai via the Government Receipt Accounting System (GRAS) system on the IGR Maharashtra website. Alternatively, the necessary charges can be paid via IGR Maharashtra. The property buyer has the option of making payments online or offline. Follow the step-by-step instructions to pay stamp duty and registration fees online in Mumbai.

Step 1: Go to https://gras.mahakosh.gov.in/igr/nextpage.php

Step 2: From the webpage, select the IGR, or Inspector General of Registration, option. The following screen will occur.

Step 3: Click the Pay without registration (if you are an unregistered user) button. On the following screen, you will be required to enter several details.

Step 4: Select the payment you want to make.

Only stamp duty charges.

Only registration charges.

Both stamp duty and registration fees

Step 5: Choose the appropriate district (in this example, Mumbai), sub-registrar office, and type of document to be registered.

Step 6: Enter the appropriate stamp duty amount. If you select the registration fee option, you will need to enter the registration fees. The property registration charge is 1% of the consideration value specified in the document (capped at Rs 30,000).

Step 7: Enter the vital facts of the concerned property and the parties involved (Buyer, Seller).

GRAS MUMBAI

Step 9: Hit the Proceed button.

Offline Payment of Stamp Duty in Mumbai

Here’s how to pay stamp duty in Mumbai offline:

Getting stamp paper: Obtaining stamp paper from an official vendor is a frequent way for Maharashtra residents to pay stamp duty in Mumbai. However, you may buy stamp paper for less than INR 50,000.

Franking: There are numerous banks in India that offer franking capabilities. Once the stamp duty is paid, the franking machine affixes the stamp on registration paperwork.

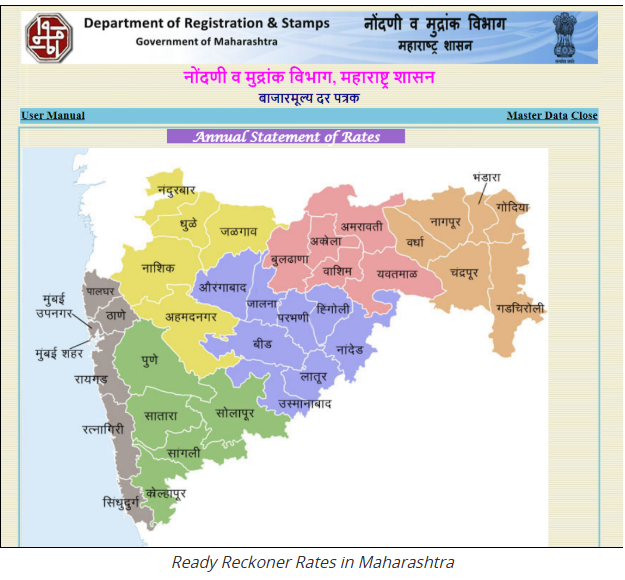

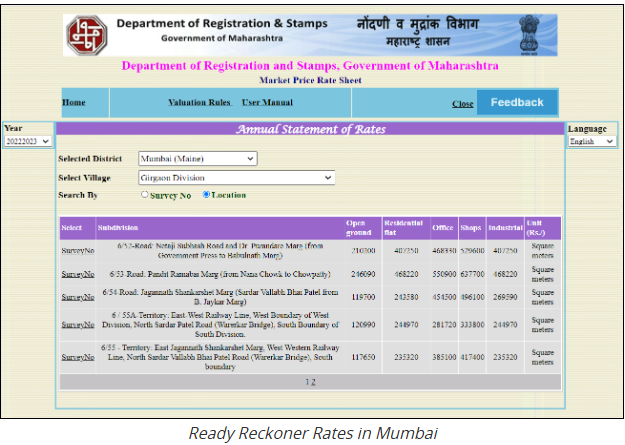

How Can I Check Ready Reckoner Rates Online in Mumbai?

The IGR Maharashtra website allows visitors to view the latest ready reckoner prices in Mumbai online. The Maharashtra government announces ready reckoner rates (RRR). The Ready Reckoner Rates are the rates below which no property transactions are permitted in a given location. The Maharashtra government routinely revises the RRR rates. Here’s a step-by-step guide to checking ready reckoner rates online at IGR Maharashtra.

Step 1: Log in to the IGR Maharashtra website

https://www.igrmaharashtra.gov.in/frmHOME.aspx

Step 2: Click the E-ASR and Process tabs.

Step 3: The following screen will appear.

Step 4: On the map, select the district (Mumbai here) for which you want to know the Ready Reckoner Rates. You have two alternatives for Mumbai: Mumbai City or Mumbai Suburb.

Step 5: When you select the district (Mumbai in this example), the following window will appear.

Step 6: In this step, select the Taluka and Village, as well as the Assessment Type and Range. Ready reckoner rates will be displayed.

Do you have to pay stamp duty on old documents?

According to the Maharashtra Stamp Act, the collector may recall property records to ensure that the stamp duty paid is correct; however, this can only be done within ten years of the registration date.

Furthermore, the Bombay High Court recently ruled that stamp duty on documents that were not properly stamped could not be recovered at a later sale. Furthermore, if the stamp duty is collected within ten years, it must be calculated using the actual market rate at the time the transaction was consummated.

Contact details for Property Registration and Stamp Duty in Mumbai

The contact information for Mumbai’s Property Registration and Stamp Duty Department is provided below.

Contact Number: 91-8888007777

Email ID: feedback@igrmaharashtra.gov.in

Summarising Stamp Duty in Mumbai

Finally, the stamp duty in Mumbai is 6% for men and 5% for women. These rates are typically utilized to stimulate home demand and property registrations in Mumbai. Stamp duties must be paid as soon as the property sale is completed, as failure to do so may result in legal difficulties later.

With transparent pricing, premium locations, and a legacy of trust, Rustomjee ensures your investment in Mumbai real estate is not just secure but truly rewarding.

FAQ’s

How Much Are Stamp Duty and Registration Charges in Mumbai?

In Mumbai, stamp duty for property acquisitions is 6% for male buyers and 5% for female buyers. Registration fees are commonly set at ₹30,000 for properties worth above ₹30 lakh or 1% for homes below that threshold. These costs are determined using the higher value of the property’s sale price versus the government’s ready reckoner rate.

Who pays registration fees buyer or seller?

For property transactions, the buyer almost always pays the registration fees and stamp duty, which are required to officially transfer the property into their name; however, legally, the seller is responsible for conveyance, so it is a common point of negotiation or standard practice for the buyer to bear. These costs, a proportion of the property’s value, are obligatory taxes to make the transaction legally acceptable. They vary by state.

Why Is Stamp Duty Paid?

Stamp duty is a government-imposed tax that is primarily used to legally verify a transaction document and assure its admissibility as evidence in court. It also generates significant cash for the government.